March 2026 Bas Due Modern Present Updated. Understanding bas due dates 2025 is crucial for every australian business owner. Missing bas statement due dates can make you pay fines from the australian taxation office (ato) and you can miss opportunities to claim deductions.

The 2025 financial year officially begins on 1 july 2025. For individuals and businesses lodging their own returns, the due date for filing. Staying ahead of business activity statement (bas) due dates is crucial for australian businesses.

Source: www.generalblue.com

Source: www.generalblue.com

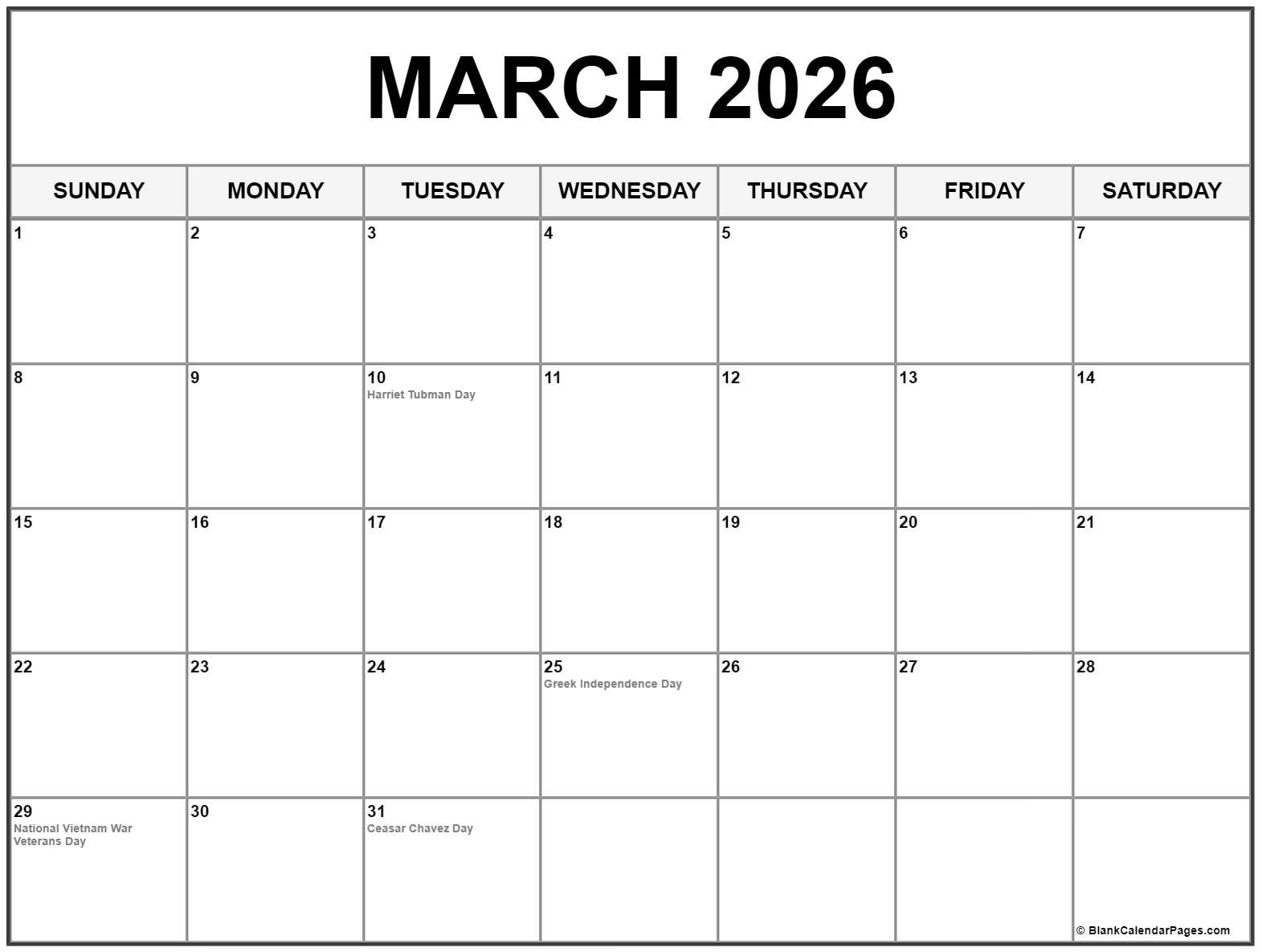

March 2026 Monthly Calendar It is important to note that if your bas due date falls on a weekend or public holiday, you have until the next business day to. Staying ahead of business activity statement (bas) due dates is crucial for australian businesses.

Source: blankcalendarpages.com

Source: blankcalendarpages.com

Collection of March 2026 photo calendars with image filters. The due date to lodge and pay your monthly bas is the 21st day of the month following the end of the taxable period. It is important to note that if your bas due date falls on a weekend or public holiday, you have until the next business day to.

Source: creditte.com.au

Source: creditte.com.au

Comprehensive Guide to BAS Due Dates in Australia The 2025 financial year officially begins on 1 july 2025. Lodgment and payment due by july 28, 2026

Source: pngtree.com

Source: pngtree.com

March Month 2026 Calendar Yellow Vector Template Download on Pngtree Lodgment and payment due by july 28, 2026 The business activity statement (bas) helps you report your tax obligations.

Source: editable-calendar.com

Source: editable-calendar.com

Download March 2026 Printable Calendar With Previous And Next Month Lodgment and payment due by january 28, 2026; The business activity statement (bas) helps you report your tax obligations.

Source: suncatcherstudio.com

Source: suncatcherstudio.com

March 2026 Calendar (Free Printable) DIY Projects, Patterns The business activity statement (bas) helps you report your tax obligations. This blog post outlines the basics about the bas for the years 2025 and 2026, including the bas return due date and ato quarterly bas due dates, yet also provides useful advice.

Source: www.calendarpedia.co.uk

Source: www.calendarpedia.co.uk

Calendar March 2026 UK with PDF, Excel and Word templates Missing bas statement due dates can make you pay fines from the australian taxation office (ato) and you can miss opportunities to claim deductions. By managing your bas statement, you get.

Source: www.tmsfinancial.com.au

Source: www.tmsfinancial.com.au

BAS Due Dates Guide 2023 for Business Owners TMS Financial Lodgment and payment due by april 28, 2026; Missing bas statement due dates can make you pay fines from the australian taxation office (ato) and you can miss opportunities to claim deductions.

Source: printablecalendaronline.com

March 2026 printable calendar The business activity statement (bas) helps you report your tax obligations. Staying ahead of business activity statement (bas) due dates is crucial for australian businesses.

Source: aliceconnor.pages.dev

Source: aliceconnor.pages.dev

Navigating Time The Importance Of A March 2026 Printable Calendar In It is important to note that if your bas due date falls on a weekend or public holiday, you have until the next business day to. Missing bas statement due dates can make you pay fines from the australian taxation office (ato) and you can miss opportunities to claim deductions.

Source: www.generalblue.com

Source: www.generalblue.com

March 2026 Monday Start Calendar (PDF, Excel, Word) Lodgment and payment due by january 28, 2026; The 2025 financial year officially begins on 1 july 2025.

Source: antoniabvega.pages.dev

Source: antoniabvega.pages.dev

Navigating The Landscape Of March 2026 A Comprehensive Guide School Understanding bas due dates 2025 is crucial for every australian business owner. Lodgment and payment due by april 28, 2026;